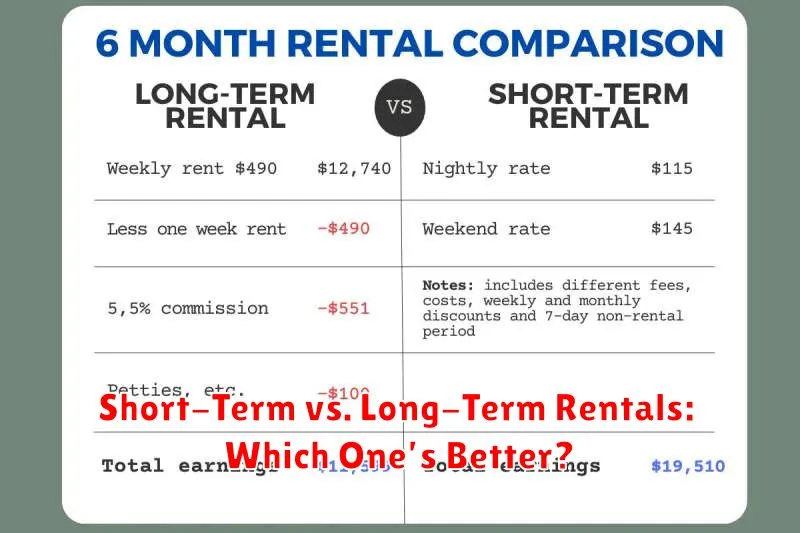

Deciding between short-term rentals and long-term rentals is a crucial decision for any property owner. Whether you’re considering renting out a vacation home, an investment property, or even your primary residence, understanding the pros and cons of each option is essential. This article explores the key differences between short-term and long-term rentals, helping you determine which strategy aligns best with your financial goals, lifestyle, and risk tolerance. We’ll delve into factors like rental income potential, maintenance costs, legal considerations, and the overall management effort required for each rental type.

From the flexibility and higher earning potential of short-term rentals to the stability and reduced vacancy rates of long-term rentals, both options offer distinct advantages and disadvantages. This article will equip you with the knowledge necessary to make an informed decision, weighing the complexities of short-term rental management against the relative ease of long-term leases. Ultimately, choosing the right rental strategy can significantly impact your return on investment and overall experience as a landlord. Explore the key factors to consider when deciding between short-term vs. long-term rentals and discover which approach is better suited for your specific circumstances.

Defining Short-Term and Long-Term Rentals

Short-term rentals typically refer to fully furnished accommodations leased for a brief period, often less than 30 days. These rentals are popular for vacationers, business travelers, and those needing temporary housing. Factors distinguishing short-term rentals include flexible lease terms, included utilities and amenities (like linens and kitchenware), and higher nightly or weekly rates compared to long-term options. They are often managed by individual owners or property management companies specializing in short-term stays.

Long-term rentals, conversely, involve leasing a property for an extended period, generally a year or more. These leases provide greater stability and predictability for both tenants and landlords. Long-term rentals often require tenants to sign formal lease agreements, pay a security deposit, and be responsible for utilities and other recurring expenses. Rent is usually paid monthly and at a lower rate per day than short-term options. Furnishings are usually the tenant’s responsibility.

The key distinctions lie in the lease duration, included amenities, and overall cost. Short-term rentals offer flexibility and convenience, while long-term rentals provide stability and lower per-day costs. The best option depends on individual needs and circumstances.

Pros and Cons of Short-Term Leases

Short-term leases offer a variety of benefits, especially for those with fluctuating housing needs or who prioritize flexibility. They allow tenants to avoid long-term commitments, making them ideal for individuals in transition, such as students, temporary workers, or those relocating. Short-term leases also provide the opportunity to test out a neighborhood before committing to a longer stay. This can be particularly helpful for newcomers to a city. Finally, short-term leases can often be furnished, simplifying the moving process and reducing upfront costs.

However, short-term leases also come with potential downsides. Higher costs are common, as landlords often charge a premium for the flexibility they offer. Renewals are not guaranteed, creating uncertainty about future housing arrangements. Finding suitable short-term accommodations can also be more challenging due to limited availability. Additionally, short-term leases may offer fewer tenant rights and protections compared to traditional long-term agreements.

Ultimately, the decision of whether or not to pursue a short-term lease depends on individual circumstances and priorities. Carefully weighing the pros and cons, considering factors like budget, location preferences, and length of stay, is crucial for making an informed choice.

Benefits of Long-Term Commitments

Long-term commitments, whether in personal relationships, career paths, or financial investments, foster stability and a sense of security. By dedicating sustained effort and focus towards a particular goal or relationship, individuals can build a strong foundation and weather challenges more effectively. This stability reduces stress and anxiety related to uncertainty, allowing for deeper emotional connections and more calculated risk-taking.

Committing to something long-term encourages growth and development. In professional settings, it allows for specialized skill development and career advancement. In personal relationships, it fosters intimacy and trust. With long-term financial investments, the power of compounding interest can lead to significant wealth accumulation. The discipline and perseverance required for long-term commitments cultivate valuable character traits like resilience and patience.

Finally, long-term commitments often result in a greater sense of purpose and fulfillment. Working towards a shared goal within a committed relationship, seeing a project through to completion, or realizing the benefits of a long-held investment provides a deep sense of satisfaction and accomplishment. This feeling of meaning contributes to overall well-being and a more rewarding life.

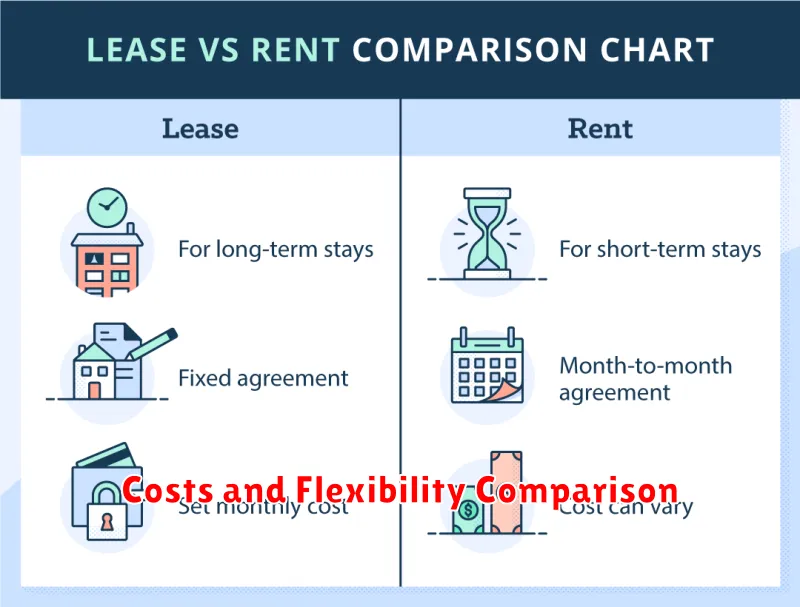

Costs and Flexibility Comparison

Cost is a crucial factor when comparing options. Consider not only the initial price, but also long-term expenses such as maintenance, upgrades, and potential hidden fees. A cheaper option upfront might incur higher costs over time, while a more expensive initial investment could offer long-term savings.

Flexibility refers to the ability to adapt to changing needs or circumstances. Evaluate how easily each option can be modified, expanded, or repurposed. A flexible solution can accommodate future growth and unexpected changes, minimizing disruption and additional costs.

Ultimately, the best choice depends on the specific needs and priorities of each situation. Carefully weigh the costs and flexibility of each option to make an informed decision.

When to Choose Each Option

Choosing the right option depends on the specific context and your priorities. If you prioritize speed and simplicity, and the task is relatively straightforward, then Option A might be the best choice. This is especially true if the consequences of a less-than-perfect outcome are minimal. Conversely, if accuracy and thoroughness are paramount, regardless of the time and effort involved, Option B is preferable. This is particularly important for complex tasks or situations where the stakes are high.

Another factor to consider is the availability of resources. Option A might be more suitable if resources are limited, as it typically requires less investment. On the other hand, if resources are readily available, including time, budget, and expertise, then Option B might be a more viable choice, allowing for a more comprehensive and potentially higher-quality outcome.

Finally, consider the level of control required. Option A often involves less control over the process and outcome, while Option B allows for greater control and customization. Ultimately, the best option is the one that best aligns with your specific needs and constraints in a given situation.

How to Transition Between Lease Types

Transitioning between lease types, such as moving from a gross lease to a net lease or vice versa, requires careful planning and communication with your landlord. Review your current lease agreement thoroughly to understand the terms and conditions, including any clauses related to early termination or lease modifications. Contact your landlord well in advance of your desired transition date to discuss your intentions and negotiate new terms. Factors like the remaining term on your current lease, market conditions, and the landlord’s willingness to negotiate will influence the process. Successfully transitioning often involves drafting a new lease agreement that reflects the agreed-upon terms.

When transitioning, understanding the key differences between lease types is crucial. For example, shifting from a gross lease where the landlord covers operating expenses to a net lease where the tenant assumes responsibility for some or all of these expenses requires a thorough assessment of the potential financial impact. Consider factors like property taxes, insurance, maintenance, and utilities. Negotiating a fair allocation of responsibilities and costs is essential for a smooth transition.

Finally, seek professional advice. Consulting with a real estate attorney or lease consultant can provide valuable guidance throughout the process. They can help you understand the legal and financial implications of the transition, review the proposed lease agreement, and ensure your interests are protected. A professional can also assist with negotiations and facilitate a successful transition between lease types.

Legal and Contract Considerations

Contracts are legally binding agreements that define the terms of a business relationship. It is crucial to carefully review and understand all clauses within a contract before signing. Key considerations include payment terms, intellectual property ownership, dispute resolution mechanisms, and termination clauses. Seeking legal counsel is highly recommended before entering into significant contractual obligations to ensure your rights and interests are protected.

Legal compliance is paramount. Businesses must adhere to all applicable laws and regulations, which can vary depending on industry, location, and the nature of the business activities. This includes considerations such as data privacy, consumer protection, and employment law. Failure to comply with legal requirements can lead to significant penalties and reputational damage.

Dispute resolution is an important element to consider when drafting or reviewing contracts. Clearly outlining the process for resolving disagreements can help mitigate potential future conflicts. Methods may include mediation, arbitration, or litigation. Choosing the right method upfront can save time, money, and resources should a dispute arise.