Renting can often feel like a financial drain, but it doesn’t have to be. Learning how to save money while renting is crucial for achieving financial stability and reaching your long-term goals, whether it’s building a down payment for a home, investing, or simply building a safety net. This article will provide practical and actionable strategies to help you save money while renting, covering everything from negotiating your rent to reducing utility costs and making smart choices about your lifestyle. By implementing these tips, you can gain control of your finances and make the most of your rental experience.

Are you tired of watching your hard-earned money disappear into monthly rent payments? Saving money while renting might seem challenging, but with the right approach, you can significantly reduce your expenses and build a stronger financial foundation. This comprehensive guide offers valuable insights and proven techniques to help you navigate the rental market, minimize your rent-related costs, and effectively save money while renting. From finding affordable rental options to optimizing your utility usage and making savvy budgeting choices, you’ll discover practical ways to stretch your budget and achieve your financial objectives while living in a rental property.

Why Budgeting Is Important for Renters

Creating and sticking to a budget is crucial for renters. Rent is typically the largest monthly expense, and a budget helps ensure you can comfortably afford it without sacrificing other essential needs. A well-defined budget allows you to track income and expenses, providing a clear picture of your financial health. This helps you avoid late payments, potential eviction, and accumulating debt. It empowers you to prioritize your spending, ensuring rent is covered while still allocating funds for groceries, utilities, transportation, and savings.

Budgeting also allows renters to plan for the future. By understanding their spending patterns, renters can identify areas where they can save money. This can be helpful for building an emergency fund, saving for a down payment on a future home purchase, or simply having financial security. A budget also helps renters anticipate and prepare for unexpected expenses, like repairs or medical bills, reducing the financial strain these situations can cause.

Finally, a budget contributes to peace of mind. Knowing that your finances are under control reduces stress and allows you to focus on other aspects of your life. Having a clear understanding of your income and expenses provides a sense of stability and control, which is especially important in the often unpredictable world of renting.

Choosing a Place Within Your Means

Finding the right place to live requires careful consideration of your budget. Before you start searching, determine how much you can comfortably afford to spend on rent or mortgage payments, including associated costs like utilities, property taxes (if applicable), and insurance. A general guideline is to allocate no more than 30% of your gross income towards housing. Creating a detailed budget will help you understand your spending habits and determine a realistic price range for your potential home. It’s crucial to be honest with yourself about your financial limitations to avoid future financial strain.

Once you have a clear understanding of your budget, you can start researching different neighborhoods and types of housing that fall within your price range. Consider factors such as location, size, and amenities. Prioritize your needs and wants. For example, if commuting is a concern, living closer to work might be worth a higher price. If space is a priority, you might consider a larger apartment further from the city center. Be prepared to make compromises and prioritize your needs based on your budget.

Finally, remember to factor in additional expenses beyond the monthly rent or mortgage payment. These can include moving costs, security deposits, and potential maintenance or repair costs. Building an emergency fund is essential to cover unexpected expenses and prevent financial hardship. By carefully considering your budget and planning for additional expenses, you can make an informed decision and choose a place that meets your needs and your financial capabilities.

Sharing Costs with Roommates

Sharing a living space requires open communication and clear agreements about finances. It’s crucial to establish these guidelines early on to prevent misunderstandings and maintain a positive living environment. Discuss all shared expenses, including rent, utilities, groceries, internet, and streaming services. Determine how these costs will be divided, whether equally, proportionally based on room size or income, or through another agreed-upon method. Documenting these agreements in writing can be incredibly helpful for future reference.

Consider utilizing budgeting apps or shared spreadsheets to track expenses and ensure everyone is contributing their fair share. This transparency can help avoid any confusion or resentment. Establish a regular payment schedule for shared bills, whether it’s monthly, bi-weekly, or another frequency that works for everyone. Be upfront about individual spending habits and preferences. For example, if one roommate prefers organic groceries while another is budget-conscious, discuss how to manage those differences respectfully.

Finally, be prepared to be flexible and understanding. Unexpected expenses may arise, and individual circumstances can change. Maintain open communication with your roommates and be willing to adjust the financial agreement as needed. Addressing any concerns promptly and respectfully will help ensure a harmonious living situation.

Cutting Utility Expenses

Reducing utility costs is a practical way to save money and minimize your environmental impact. Evaluating your current usage is the first step. Analyze your electricity, water, and gas bills to identify areas of high consumption. Simple changes like switching to energy-efficient light bulbs, unplugging electronics when not in use, and taking shorter showers can make a noticeable difference. Additionally, consider investing in smart thermostats and other energy-saving devices to automate and optimize your home’s energy consumption.

Weatherizing your home can significantly reduce energy waste. Sealing air leaks around windows and doors prevents drafts and keeps your home at a comfortable temperature without overworking your heating and cooling systems. Adding insulation to attics, walls, and floors further minimizes heat transfer, leading to lower energy bills year-round. These improvements not only save money but also enhance your home’s comfort.

Finally, explore available programs and resources. Many utility companies offer rebates and incentives for energy-efficient upgrades. Contact your local provider to learn about available programs. Also, research government initiatives that promote energy conservation. Taking advantage of these resources can help offset the upfront costs of energy-saving improvements and further reduce your utility expenses.

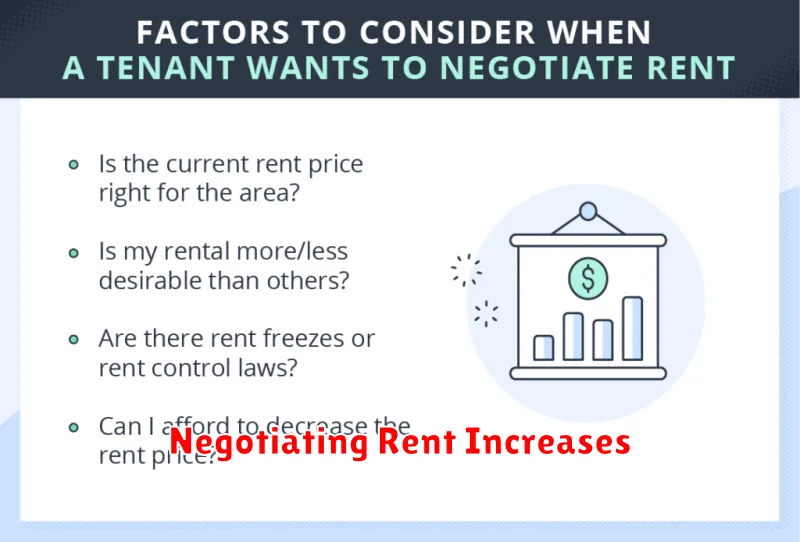

Negotiating Rent Increases

Rent increases are a common occurrence, but that doesn’t mean you have to accept them passively. Negotiating with your landlord can often lead to a smaller increase or even no increase at all. Before approaching your landlord, research the average rent for comparable properties in your area. This will give you leverage and demonstrate that you’re aware of the market value. Also, consider the length of time you’ve lived in the unit and your payment history. A good tenant with a history of on-time payments is a valuable asset to a landlord.

When you’re ready to discuss the rent increase, approach your landlord with a respectful and professional attitude. Clearly state your reasons for wanting to negotiate, highlighting your positive attributes as a tenant and the current market rates. Be prepared to compromise. Perhaps you can agree to a smaller increase than the one initially proposed, or suggest improvements to the property in exchange for a lower rent. Keeping the lines of communication open is key to reaching a mutually beneficial agreement.

If negotiations are unsuccessful and you believe the rent increase is unjustified, be sure to understand your rights as a tenant based on your local laws and the terms of your lease agreement. Document everything in writing, including any communication with your landlord. This documentation can be valuable if further action is necessary.

Avoiding Unnecessary Fees

Unnecessary fees can significantly impact your finances. Being aware of common fee traps and taking proactive steps to avoid them can help you save money. These fees can range from banking charges like overdraft and ATM fees to late payment penalties on bills and subscription services. By understanding the various types of fees and implementing strategies to circumvent them, you can keep more of your hard-earned cash.

Common unnecessary fees include overdraft fees, ATM fees, late payment fees, and subscription fees for unused services. Carefully monitor your account balances to avoid overdraft charges. Use in-network ATMs whenever possible to minimize or eliminate ATM withdrawal fees. Set up automatic payments or reminders for bills to avoid late payment penalties. Regularly review your subscriptions and cancel any services you no longer use.

Taking control of your finances by actively managing your accounts and staying informed about potential fees can make a big difference in your overall financial well-being. By implementing these strategies, you can effectively minimize or eliminate unnecessary expenses and maximize your savings.

Tracking Your Monthly Spending

Tracking your monthly spending is crucial for understanding your financial health and working towards your financial goals. By diligently monitoring where your money goes, you can identify areas where you may be overspending and make necessary adjustments to your budget. This allows you to gain control of your finances, save more effectively, and work towards financial security.

There are several effective methods to track your spending. You can use traditional methods like pen and paper, or leverage the many available budgeting apps. Many banks and credit card companies also offer online tools to categorize your transactions. Choose a method that works best for your lifestyle and stick with it consistently for accurate results. Regularly reviewing your tracked spending, ideally monthly, is key to identifying trends and making informed financial decisions.

By understanding your spending habits, you can prioritize your expenses and allocate your resources more effectively. This empowers you to make informed choices about your spending and savings, ultimately putting you in a stronger financial position.