Are you considering renting an apartment or house? One of the most important decisions you’ll face is whether to purchase renters insurance. While not legally required in most places, renters insurance offers significant financial protection that can save you from substantial out-of-pocket expenses in the event of unforeseen circumstances. This article will delve into the specifics of renters insurance, exploring what it covers, why you might need it, and ultimately help you answer the crucial question: should you buy renters insurance?

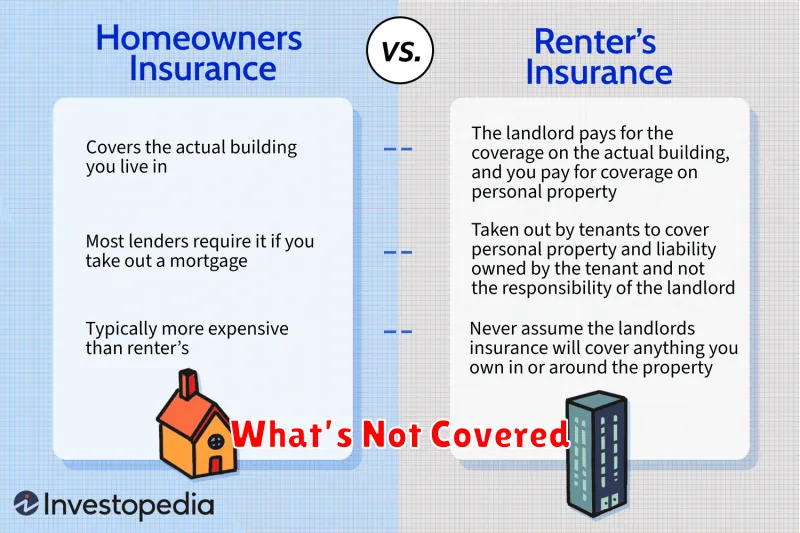

Understanding the value proposition of renters insurance is crucial for anyone entering a rental agreement. Many renters mistakenly believe their landlord’s insurance policy covers their belongings, which is rarely the case. Renters insurance provides coverage for your personal property, your liability, and even your additional living expenses if your rental becomes uninhabitable. We’ll examine these benefits in detail, providing clear examples and explaining how renters insurance can provide peace of mind and crucial financial security. From the cost of renters insurance to the coverage options available, we’ll equip you with the knowledge you need to make an informed decision about protecting yourself and your possessions.

What Is Renters Insurance?

Renters insurance is a type of property insurance that provides coverage for a policyholder’s belongings within a rented property. It protects against losses from events like fire, theft, vandalism, and certain types of water damage. Importantly, it does not cover the structure itself, as that is the landlord’s responsibility. Renters insurance also typically includes liability coverage, which protects the policyholder if someone is injured on their property and decides to sue.

Policies generally cover personal possessions such as furniture, electronics, clothing, and jewelry. The coverage amount can be customized to reflect the value of your belongings. There are typically two types of coverage available: actual cash value and replacement cost. Actual cash value takes depreciation into account, while replacement cost provides funds to purchase new items of similar kind and quality. Choosing the right coverage is crucial for ensuring adequate protection in the event of a loss.

Renters insurance is generally affordable and offers significant financial protection for a relatively small cost. It provides peace of mind knowing that your belongings are protected against unforeseen events. While your landlord’s insurance covers the building, it won’t cover your personal items. Therefore, renters insurance is highly recommended for anyone renting a home or apartment.

What Does It Cover?

This document covers the essential information regarding the specified topic. It provides a concise overview of the key concepts, highlighting the most important aspects for a quick understanding. The information presented here is intended to serve as a starting point for further exploration and should not be considered exhaustive.

Key areas addressed include the scope of the topic, its relevance, and potential implications. It also briefly touches upon the historical context and current applications where applicable. This summary aims to provide a clear and focused perspective on the subject matter.

While this document aims to be comprehensive in its brief overview, certain detailed aspects might be omitted for brevity. For a more in-depth analysis, please consult the accompanying documentation or referenced materials.

What’s Not Covered

This document outlines the scope of the current project and specifically details items that are not included in the current phase. Understanding these exclusions is crucial for managing expectations and ensuring alignment on deliverables. While these features and functionalities may be considered valuable, they fall outside the currently defined scope due to various factors such as time constraints, budgetary limitations, or strategic prioritization.

Key exclusions include integration with third-party platform X, development of a mobile application, and implementation of advanced reporting features. These items, while potentially beneficial, were deemed outside the current project scope. Future phases may incorporate these elements depending on evolving needs and resource availability.

Specific functionalities within the core platform are also excluded, such as user role customization and automated email notifications. These features, while seemingly minor, introduce significant complexity and require further investigation before inclusion. Their omission allows the project to remain focused on delivering the core functionalities within the agreed-upon timeframe and budget.

How Much Does It Cost?

Determining the cost depends on several key factors. These typically include the specific product or service being considered, any applicable taxes or fees, and potential discounts or promotions. Variations in pricing can also arise from factors such as location, vendor, and chosen features or customizations.

For accurate pricing information, it’s always best to consult directly with the seller or provider. They can provide a tailored quote based on your individual needs and circumstances. Looking at official websites or contacting customer service are generally reliable ways to obtain current and valid pricing details.

In some cases, online price comparison tools or independent review sites can offer helpful insights into average market rates. However, remember to verify this information with official sources before making any purchasing decisions.

How to Choose a Policy That Fits You

Choosing the right policy can feel overwhelming, but by focusing on a few key factors, you can simplify the process. First, assess your needs. What are you hoping to protect or achieve with this policy? Consider your current situation, future goals, and potential risks. For example, a young family’s needs will differ significantly from those of a retired couple. Clearly defining your objectives will help you narrow down the options and choose a policy that aligns with your specific requirements.

Next, compare different policy types. Once you understand your needs, research the various policies available. Pay close attention to the coverage details, benefits offered, and any exclusions or limitations. Don’t hesitate to ask questions and seek clarification on anything you don’t understand. Comparing policies side-by-side can be helpful in identifying the best value for your money. Consider factors like premiums, deductibles, and co-pays to get a complete picture of the overall cost.

Finally, evaluate the provider’s reputation. Choosing a reputable and financially stable provider is crucial. Research the company’s history, financial strength, and customer satisfaction ratings. A provider with a strong track record is more likely to be reliable and provide excellent service when you need it most. Don’t be afraid to consult with a financial advisor or insurance broker for professional guidance. They can provide valuable insights and help you navigate the complexities of choosing the right policy.

Filing a Claim: Step-by-Step

First, gather all necessary documentation. This typically includes the completed claim form, incident reports, supporting evidence (such as photos or witness statements), and any relevant policy information. Ensure all information is accurate and complete to avoid delays in processing. Review your policy carefully to understand the specific requirements for your claim type.

Second, submit your claim through the appropriate channels. This might involve submitting your documents online, mailing them to a specific address, or contacting your claims representative directly. Confirm receipt of your claim and obtain a claim number for future reference and tracking.

Third, monitor your claim status. You should receive updates regarding the progress of your claim. If you have any questions or require additional information, contact your insurer or claims representative promptly. Be prepared to provide additional documentation or answer questions related to your claim.

Why It’s Worth Considering

Taking the time to consider all options before making a decision is crucial. Rushing into things can lead to unforeseen consequences and regret. A thoughtful approach allows for a more thorough understanding of the situation, potential outcomes, and ultimately, better choices. This applies to all areas of life, from personal decisions to professional endeavors.

Considering different perspectives is also essential. By actively seeking out and evaluating diverse viewpoints, you gain a broader understanding of the issue at hand. This can reveal hidden opportunities or potential pitfalls that you might otherwise miss. Ultimately, incorporating various perspectives leads to more well-rounded and informed decisions.

Finally, careful consideration reduces risk and increases the probability of success. By weighing the pros and cons, identifying potential challenges, and developing contingency plans, you are better prepared for any outcome. This proactive approach minimizes the chance of negative consequences and maximizes the likelihood of achieving your desired results.