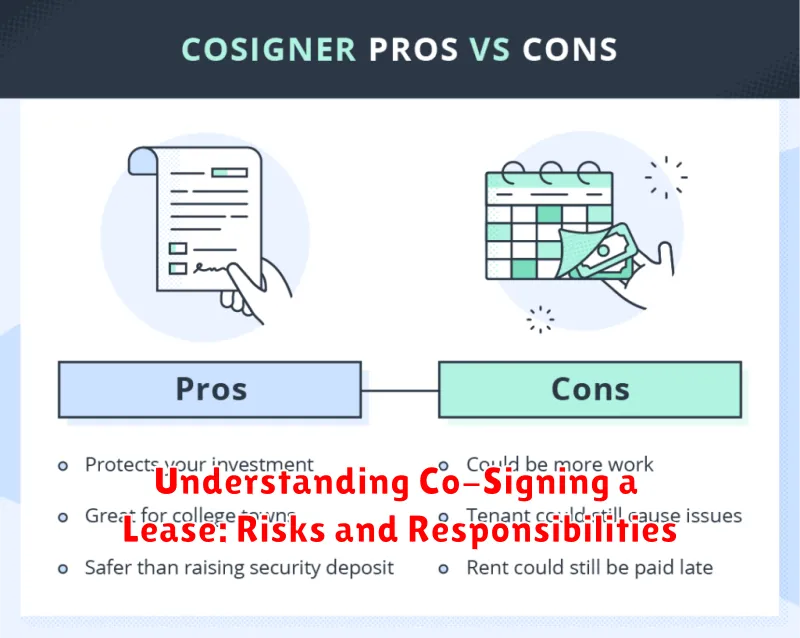

Co-signing a lease is a significant financial decision that carries both risks and responsibilities. Whether you’re considering co-signing for a friend, family member, or someone else, it’s crucial to fully understand the implications before you sign on the dotted line. This article will explore the potential risks of co-signing, outline the responsibilities of a co-signer, and provide essential information to help you make an informed decision. Understanding the terms of a co-signed lease is paramount to protecting your financial future.

Entering into a co-signer agreement means you’re equally responsible for fulfilling the terms of the lease agreement, including rent payments, property damage, and other obligations. Should the primary tenant default on their lease responsibilities, you, as the co-signer, are legally obligated to cover the costs. Therefore, before agreeing to co-sign a lease, carefully consider the potential financial burden and the relationship with the potential tenant. This commitment could significantly impact your credit score and finances if the primary tenant fails to uphold their end of the lease agreement.

What Does It Mean to Co-Sign?

Co-signing means you agree to be legally responsible for a debt if the primary borrower fails to repay it. You are essentially vouching for the borrower and promising to the lender that the loan will be paid. This applies to various types of debt, including loans, leases, and credit cards. As a co-signer, you are taking on significant risk, as you are equally responsible for the full amount owed, including any late fees or collection costs. Before agreeing to co-sign, it’s crucial to understand the full implications and potential consequences.

The lender will check your credit history and financial standing before approving the loan with you as a co-signer. This is because they are relying on your ability to repay the debt if necessary. If the primary borrower misses payments or defaults on the loan, the lender will likely contact you to collect the outstanding balance. This negative activity can impact your own credit score, making it harder for you to obtain credit in the future. Furthermore, the lender may pursue legal action against both you and the primary borrower to recoup the debt.

It’s essential to consider co-signing a loan only if you are willing and able to repay the full amount yourself. It’s also important to have a frank conversation with the borrower about their repayment plan and your expectations. Remember, co-signing is a serious financial obligation that should not be taken lightly.

When You Might Need a Co-Signer

A co-signer agrees to be legally responsible for a debt if the primary borrower defaults. This added security can make you eligible for loans or credit cards you wouldn’t qualify for on your own. You might need a co-signer if you have a limited or poor credit history, a low income, or lack of credit history altogether. Lenders view these factors as risky, and a co-signer reduces their risk by providing a backup repayment source.

Several situations often require a co-signer. These include applying for your first credit card, securing a car loan with limited credit, or getting approved for an apartment lease. In each of these cases, the lender or landlord wants assurance that the debt will be paid, even if you experience financial difficulty. A co-signer with a strong credit score and stable income can provide that reassurance.

It’s important to understand that co-signing is a serious financial commitment. The co-signer’s credit will be impacted by your payment behavior. Late or missed payments will negatively affect both your credit and your co-signer’s credit. Therefore, it’s crucial to only borrow what you can afford to repay and communicate openly with your co-signer about the loan’s progress.

Financial and Legal Responsibilities

Financial responsibilities encompass the ethical and legal obligations an individual or entity has regarding financial matters. These include accurate reporting, transparent transactions, and adherence to applicable financial regulations. Key aspects often include responsible budgeting, debt management, and timely payment of taxes and other financial obligations. Meeting these responsibilities ensures financial stability and fosters trust in personal and professional relationships.

Legal responsibilities are duties imposed by law, requiring compliance to avoid legal consequences. These obligations vary depending on jurisdiction and personal circumstances, but often involve respecting contracts, adhering to property laws, and upholding other statutory requirements. Fulfilling these responsibilities is crucial for maintaining social order and a just legal system.

Both financial and legal responsibilities are integral to ethical conduct and societal well-being. Understanding and upholding these duties contribute to individual financial health, strong business practices, and a responsible citizenry.

Impact on Credit and Liability

Unauthorized credit card use can severely impact your credit score. If fraudulent charges are not disputed promptly, they can lead to higher balances, missed payments, and ultimately, a lower credit score. This can make it harder to obtain loans, rent an apartment, or even secure certain jobs in the future. It is crucial to monitor your credit report regularly and report any suspicious activity immediately.

Liability for unauthorized charges varies depending on the circumstances and how quickly the issue is reported. Federal law limits consumer liability for unauthorized credit card charges to $50, provided the card issuer is notified promptly. However, if you report the loss or theft of your card before any unauthorized charges are made, you typically have zero liability. Debit cards have slightly different rules, with liability potentially increasing depending on how long it takes to report the loss or theft.

Taking proactive steps is vital to minimize the impact of unauthorized credit card use. These steps include regularly checking your credit card statements, setting up account alerts for suspicious activity, and reporting lost or stolen cards immediately. By being vigilant and taking swift action, you can protect your credit and limit your financial liability.

Alternatives to Co-Signing

Co-signing a loan can have significant risks, entangling your own credit with the borrower’s. If the primary borrower defaults, you become fully responsible for the debt, potentially damaging your credit score and leading to collection efforts against you. Therefore, exploring alternatives to co-signing is highly recommended. Before agreeing to co-sign, discuss other options with the borrower.

Several alternatives can help someone qualify for a loan without requiring a co-signer. These include secured loans, which use collateral to mitigate the lender’s risk; building credit through secured credit cards or credit-builder loans; seeking loans from credit unions or community banks, which sometimes have more flexible lending criteria; and exploring government-backed loan programs specifically designed to assist borrowers with limited credit history. Additionally, the borrower can try to improve their credit score by paying down existing debts and correcting any errors on their credit report. These options allow the borrower to access credit independently, avoiding the potential pitfalls of co-signing.

Ultimately, carefully weigh the risks and benefits before co-signing. If you’re uncomfortable with the potential consequences, clearly communicate your concerns and suggest the alternatives outlined above. Remember, protecting your own financial well-being is paramount.

What to Know Before Agreeing to Co-Sign

Co-signing a loan means you’re agreeing to be legally responsible for the debt if the primary borrower defaults. This is a serious financial commitment that shouldn’t be taken lightly. Before you sign, fully understand the terms of the loan, including the interest rate, repayment schedule, and any associated fees. Carefully consider the borrower’s financial situation and their ability to repay the loan independently. Remember, if they fail to make payments, you are responsible for the entire balance, potentially damaging your credit score and financial stability.

Co-signing can significantly impact your own borrowing power. Lenders view co-signed debt as part of your existing debt obligations, even if the primary borrower is making timely payments. This can make it more difficult for you to obtain credit for yourself, such as a mortgage or car loan, as it increases your debt-to-income ratio. Additionally, if the borrower misses payments or defaults on the loan, your credit score will likely suffer. This can have long-term consequences, affecting your ability to access credit and secure favorable interest rates in the future.

Before co-signing, explore alternative options for the borrower. Could they qualify for a loan with a co-borrower instead of a co-signer? Are there other sources of financial assistance available, such as grants or scholarships? Have an open and honest conversation with the borrower about the responsibilities involved and the potential risks to both parties. It’s crucial to make an informed decision based on a clear understanding of the implications involved in co-signing a loan.

Tips for Protecting Yourself

Personal safety is paramount. Be aware of your surroundings at all times. Avoid walking alone, especially at night or in isolated areas. If you must travel alone, let someone know your route and expected arrival time. Stay alert and avoid distractions like looking at your phone while walking. If you sense you are being followed, cross the street or enter a public place.

Protect your personal information. Be cautious about sharing personal details online, especially on social media. Use strong, unique passwords for all your accounts and enable two-factor authentication whenever possible. Be wary of phishing scams and avoid clicking on suspicious links or attachments in emails or text messages. Regularly monitor your bank and credit card statements for unauthorized activity.

Home security is crucial. Ensure all doors and windows are locked, even when you are home. Consider installing a security system or motion-sensor lights. Trim bushes and trees around your property to eliminate hiding spots. If you are going away, make your home look occupied by using timers for lights and asking a trusted neighbor to collect your mail.